The 10-Second Trick For Property By Helander Llc

The Best Guide To Property By Helander Llc

Table of ContentsSome Ideas on Property By Helander Llc You Should KnowGetting My Property By Helander Llc To WorkEverything about Property By Helander LlcNot known Details About Property By Helander Llc What Does Property By Helander Llc Mean?Some Known Questions About Property By Helander Llc.

The benefits of spending in actual estate are many. Right here's what you need to know regarding real estate benefits and why real estate is considered an excellent financial investment.The benefits of spending in real estate include easy income, secure cash circulation, tax advantages, diversification, and utilize. Real estate investment trusts (REITs) supply a way to invest in real estate without having to have, run, or money homes.

In lots of instances, capital only reinforces over time as you pay down your mortgageand develop your equity. Actual estate investors can benefit from countless tax breaks and deductions that can save money at tax time. As a whole, you can subtract the sensible expenses of owning, operating, and managing a home.

Property By Helander Llc Fundamentals Explained

Real estate worths tend to enhance in time, and with a great investment, you can make a profit when it's time to market. Rental fees additionally tend to climb over time, which can bring about greater capital. This graph from the Reserve bank of St. Louis reveals mean home costs in the united state

The locations shaded in grey indicate united state recessions. Average Sales Price of Houses Marketed for the USA. As you pay down a building mortgage, you develop equityan asset that belongs to your web worth. And as you develop equity, you have the take advantage of to acquire even more residential or commercial properties and enhance capital and wide range much more.

Due to the fact that property is a concrete asset and one that can offer as collateral, financing is easily available. Realty returns differ, depending upon elements such as location, possession class, and monitoring. Still, a number that many capitalists go for is to beat the ordinary returns of the S&P 500what several individuals refer to when they say, "the marketplace." The rising cost of living hedging capacity of genuine estate comes from the positive partnership in between GDP growth and the need for genuine estate.

The 3-Minute Rule for Property By Helander Llc

This, consequently, converts right into higher resources values. Real estate often tends to maintain the acquiring power of resources by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the form of capital gratitude. Mortgage financing discrimination is unlawful. If you think you've been differentiated against based on race, religious beliefs, sex, marriage status, use public aid, nationwide origin, handicap, or age, there are steps you can take.

Indirect realty spending entails no direct ownership of a property or residential or commercial properties. Instead, you buy a swimming pool along with others, where an administration business owns and operates homes, otherwise owns a portfolio of mortgages. There are numerous methods that possessing property can secure against inflation. Residential or commercial property values might climb greater than the rate of inflation, leading to resources gains.

Finally, homes financed with a fixed-rate loan will see the relative amount of the month-to-month home loan settlements tip over time-- for example $1,000 a month as a set payment will end up being less challenging as rising cost of living wears down the buying power of that $1,000. Often, a key house is ruled out to be a realty investment considering that it is used as one's home

The Main Principles Of Property By Helander Llc

Also with the assistance of a broker, it can take a few weeks of work simply to discover the ideal counterparty. Still, realty is a distinctive property class that's easy to understand and can enhance the risk-and-return account of an investor's profile. By itself, realty offers cash money flow, tax obligation breaks, equity structure, competitive risk-adjusted returns, and a bush against rising cost of living.

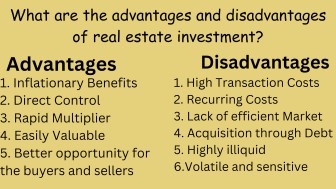

Investing in property can be an exceptionally gratifying and financially rewarding endeavor, however if you're like a great deal of new investors, you may be wondering WHY you ought to be purchasing realty and what benefits it brings over various other investment possibilities. In enhancement to all the outstanding advantages that come along with investing in genuine estate, there are some downsides you need to take into consideration.

Getting The Property By Helander Llc To Work

If you're searching for a method to get into the realty market without needing to invest numerous hundreds of dollars, check out our homes. At BuyProperly, we make use of a fractional ownership model that allows investors to start with as little as $2500. An additional major benefit of realty investing is the ability to make a high return from buying, refurbishing, and marketing (a.k.a.

The Main Principles Of Property By Helander Llc

If you are billing $2,000 rental fee per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax i was reading this obligation on that $500 profit per month (sandpoint id realtors). That's a huge difference from paying taxes on $2,000 per month. The revenue that you make on your rental system for the year is taken into consideration rental revenue and will certainly be tired accordingly